You don’t require superior credit rating to acquire a same-day personal loan. Quite a few lenders have considerably less stringent credit history rating specifications and approve borrowers with all kinds of credit history scores.

Whether or not financing a home renovation, a wedding, or possibly a desire vacation, LightStream delivers quick funding and personalised company to help borrowers accomplish their goals with assurance.

The army also provides economic enable and help running your hard earned money. In the event you’re dealing with economical issues, talk to a Personal Economical Supervisor (PFM) about your choices. Do you want more the perfect time to pay out your payments or perhaps a attainable advance on your paycheck?

When loans from spouse and children or friends usually are not to be taken or produced flippantly, it may be a possibility for any person needing cash faster than a bank could mail it.

All those substantial-interest prices can result in you spending in excess of the loan’s principal. Interest fees tend to be the decisive aspect For numerous borrowers. Store about and discover lenders offering reduced costs, then slender the listing with the opposite parameters.

Take into consideration a lengthier loan term if you really feel nervous about earning loan payments. While you can pay additional curiosity, dispersing the principal throughout a longer term will reduce your regular payments.

95% to 35.99%) is about the high-end for applicants with a very good to excellent credit history score—and there is no autopay price cut. Even now, the platform earns top marks for borrowers with under stellar credit history who need to have speedy use of cash.

Negotiate all payments You should make and request a 'payment holiday break'. Use to all unexpected emergency money schemes for which you're suitable. Maintain yourself clear, tidy, and presentable. Begin earning revenue; speedy.

With fast funding and customized provider, Upstart provides modern solutions for borrowers looking to accomplish their financial ambitions.

The borrowing interval lasts quite a few many years; then, the borrower will owe month check here to month installments about the loan total additionally fascination. HELOCs offer lower curiosity premiums than same-working day loans, and the borrower has a long time to repay the equilibrium owing little by little. The downside is you use your house as collateral, which means you may reduce your house in case you default. In addition, it requires for a longer time than the usual working day for being permitted.

Upstart leverages artificial intelligence and equipment Finding out to evaluate borrowers' creditworthiness beyond regular components, causing aggressive fees and better acceptance costs for competent applicants.

Ask for a credit rating limit maximize. Spending off current debt is not the only way to lessen your credit rating utilization ratio. Since your credit utilization looks at the amount of one's obtainable credit you utilize, rising your credit score Restrict can realize the same purpose.

The ways earlier mentioned outline the method, but the precise needs to qualify to get a loan may possibly change by lender. If acquiring a loan at top rated speed is your priority, it’s encouraged to prequalify for that loan if at all possible and study the lender’s needs beforehand. Doing so will clean out the highway ahead and enable you receive the loan around the same working day.

The loan’s collateral serves like a ensure of repayment since the lender usually takes possession of it in the event you default within the loan.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Anna Chlumsky Then & Now!

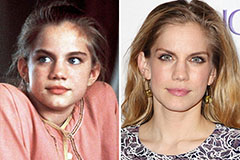

Anna Chlumsky Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!